The Truth About Price Action

What is Price Action

Price action trading is a procedure for financial market speculation which consists of the analysis of basic price movement across time. It’s used by many retail traders and often by institutional traders to make predictions on the future direction of the price of a financial market.

Let us simply say price action is the raw price data of a market without indicators. The analysis part is learning to read the price movement and make a trade based upon candlesticks and patterns.

Indicators are the mathematical formulae that traders use on their charts to decide when to make trades. And, without them, it can be difficult to act on the insights the data provides, but indicators aren’t without limitations. They can be delayed, based on past data and don’t always tell the whole story. A price action analysis is a simpler and sometimes more accurate way to make the right decision.

Let’s get to the peak of the matter of the truth about price action in this Post.

Price action is a trading TECHNIQUE that allows a trader to read the market and make subjective trading decisions based on the actual and recent price movements. Here, traders are free to make their own decisions to aid effectiveness and efficiency in trading. It of course helps in proper planning. This is one of the bases of every successful forex trader. But then, there is a big question?

Start your free five-day trial in any of our courses right now

Why Do You Need To Know About Price Action?

Core characteristics of price action analysis

Here are the basic things you need to know:

- Price action describes the price movements of an asset/item’s price when it’s plotted over time. This movement is quite often analyzed with respect to price changes in the past retrospective ones often you’ll see charts with averages plotted on, but raw price charts have the candlesticks.

- Price action trading ignores though not totally the fundamental factors that influence a market’s movement, and instead, it looks primarily at the market’s price history, that is to say, its price movement across a period. Thus, price action is a form of technical analysis.

- In other words, price action trading is a ‘pure’ form of technical analysis since it includes no second-hand, price-derived indicators. Price action traders are solely concerned with the first-hand data a market generates about itself; its price movement over time.

Experienced price action traders often attribute their unique mental understanding of a market as the main reason for their profitable trading. And the JayyyFxAcademy focuses on price action trading strategies to generate a swift profit over a short time frame. You want this right? Of course, you do.

Start your free five-day trial in any of our courses right now

Which Tools Are Used For Price Action Trading?

As stated earlier, price action trading relates to recent history and past price movements, all technical analysis tools like charts, lines, price bands, high and low swings, technical levels, etc. These are taken into consideration based on the laid out scheme and the trader’s choice too. Many traders use candlestick charts for trading decisions since they help better visualize price movements by displaying the open, high, low, and close values in the context of up or down sessions.

Many short-term traders rely exclusively on price action and the formations and trends learned from it to make trading decisions.

Funny enough, price action trading is more of an art than a science i.e. two traders may arrive at different conclusions when analyzing the same price action. One trader may see a downtrend, while another might believe that the price action shows the possibility of a turnaround — purely based on their personal experience reading the charts.

The tools and patterns observed by the trader can be simple price bars, volatility, (Remember Volatility? – The measure of how drastically a market’s prices change). channels, break-outs, trend lines, price bands, or complex combinations involving candlesticks, etc. All of which JayyyFxAcademy will explain simply. Yeah, that’s why it’s an academy with simplicity!

Since price action trading is an approach to price introspection and predictions. It is used by retail Traders often to check for possible price changes. Price action is a forex strategy that helps to predict market movements by spotting patterns or signals in the price movements of an underlying market.

Price action in trading analyzes the performance. Hence, predicts what it might do in the future of an index or commodity. If your price action analysis is the best. JayyyFxAcademy would teach you how to make accurate predictions, taking calculated risks and so much more.

Price action tells you that the price is about to fall, you might want to believe that the price will rise. This is where the human determinant lies. Here, varying interpretations and subsequent actions come in.

These and many other determinants also make up an important aspect of price action trades. For example in the diagram above, A trader might decide that EURUSD should sell to 1.12825 and another Trader might say that the Market should have a short buy before selling the EURUSD pair (which was the position we at JayyyFxAcademy took and it ended in Profits.

Here, you can see that you play a major determinant role too.

Understanding price action trading involves looking at patterns and identifying the key factors that might have an impact on your investments. There are several different price action methods that many traders use to predict market movements and make short-term gains.

Here we help you in spotting patterns or signals in the price movements of an underlying market and accurately help predict what it might do in the future, involving looking at patterns and identifying the key indicators that might have an impact on your investments.

With JayyyFxAcademy, you learn risk management techniques with proper planning, you’ll learn proven trading schemes especially patterns developed like us like the Jayyy Touch Pattern, Jayyy Slide Pattern, Jayyy Support, and Resistance lines, and much more and of course with SIMPLICITY.

Start your free five-day trial in any of our courses right now

Price Action Trading Strategies (Patterns)

Price action patterns, also called price action triggers, setups, or signals, are really the most important aspect of price action trading because it’s these patterns that provide a trader with strong clues as to what price might do next.

The following diagrams show examples of some simple price action trading strategies that you can use to trade the market.

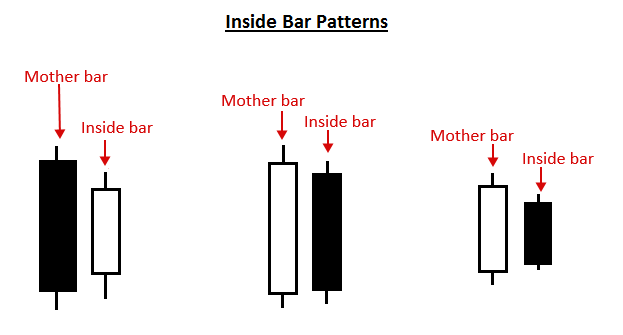

Inside bar pattern

An inside bar pattern is a two-bar pattern, consisting of the inside bar and the prior bar which is usually referred to as the “mother bar”. The inside bar is contained completely within the high to low range of the mother bar. This price action strategy is commonly used as a breakout pattern in trending markets, but it can also be traded as a reversal signal if it forms at a key chart level.

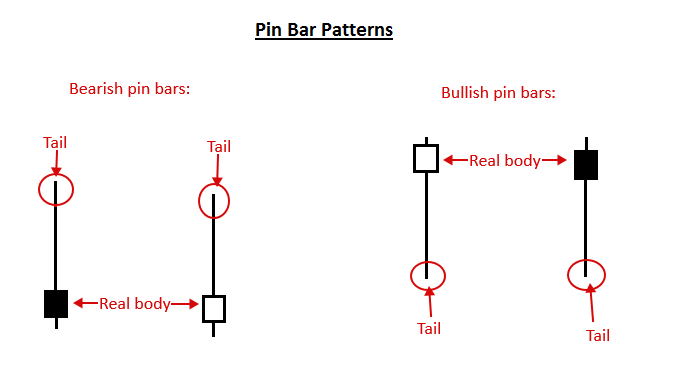

Pin bar pattern

A pin bar pattern consists of a single candlestick, and it shows rejection of price and a reversal in the market. The pin bar signal works great in a trending market, range-bound market, and can also be traded counter-trend from a key support or resistance level. The pin bar implies that the price might move opposite from the direction the tail is pointing; as it’s the tail of the pin bar that shows rejection of price and a reversal.

Trading Price Action Patterns with Confluence

Trading with price action signals is not only about the signal itself, but it’s also about where the signal forms on the chart. Every pin bar, inside bar, etc. is not created equal. Depending on where a particular price action signal forms in a market, you may not want to trade it or you may want to jump on it without hesitation.

The best price action signals are those that form at confluent points in the market. Confluence, simply means a coming together of people or things. In the case of price action trading, we are looking for an area on the chart where at least a couple of things line up with a price action entry signal. When this happens, we say the price action signal has confluence. The more confluent factors a price action signal has behind it, the higher-probability signal it is considered to be.

You want a further knowledge about Price action

Start your free five-day trial in any of our courses right now

Learn the Art of Forex Trading

Do you want to know more about trading? Start your free five-day trial in any of our courses right now.

We have three powerful courses to get you started, regardless of your learning style. You can choose courses taught by real-world experts and learn at your own pace with Jayyy Forex Academy, which offers lifetime access on mobile and desktop. You’ll also learn the fundamentals of trading, other financial assets, advanced forex strategies, and much more. Learn more about Jayyy Forex Academy and get started right away.

Conclusion.

As you’ve been enlightened on the concepts of Price Action with relatable examples.

Do you find this article helpful?

Which section do you find most juiced with information? Would you want more of this? Your reply in the comment section below will be highly appreciated! Thank you.