Bid, Ask and Spread in the Forex Market

The difference between the price a broker will purchase and sell a currency is known as the bid-ask spread (also known as the buy-sell spread). However, in the retail market, the spread, or the difference between the bid and ask price for a currency, can be substantial, and it can also change dramatically from one broker to the next.

The first step in comprehending the significance of huge spreads in the foreign currency market is to understand how exchange rates are computed. Furthermore, researching the greatest exchange rate is always in your best interest.

Start your free five-day trial in any of our courses right now

IMPORTANT TAKEAWAYS

- The bid-ask spread (also known as the buy-sell spread) is the difference between the price at which a broker is prepared to sell a currency and the price at which they will buy it.

- Because exchange rates differ by a broker, it’s critical to shop around for the best value before exchanging any currencies.

Start your free five-day trial in any of our courses right now

The Retail Forex Market’s Bid-Ask Spreads

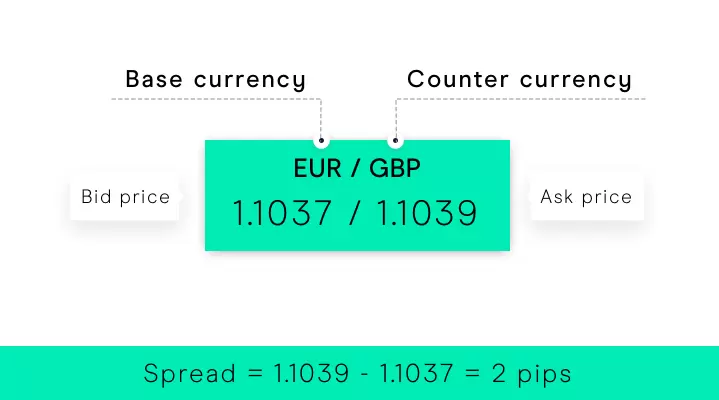

The bid price is the rate at which a broker is willing to buy a currency, while the asking price is the rate at which the same currency will be sold.

Alice, for example, is a Canadian tourist in Europe. The following is the cost of purchasing euros at the bank:

1 EUR = 4.50 USD / 4.60 USD

The higher price (USD 4.60) represents the cost of purchasing one euro. Alice wants to buy EUR 5,000; thus, she’ll have to pay USD 23,000 to the dealer.

Assume that the next person in line has just returned from a European vacation and is looking to sell the euros they have leftover. Candice is looking to sell EUR 5,000. They can sell the euros at the lower bid price of USD 4.50 and receive USD 22,500 in exchange for their euros.

The bureau de change dealer can earn USD 500 because of the bid-ask spread.

Here’s another example:

Emeka is a banker that makes smart money moves. He has 50 units of shares from MTN and 1 MTN share is equivalent to 19 USD/ 20 USD. Due to the announcement that the Federal government of Nigeria has given instructions to ban citizens without a National Identification Number from making calls, he decided to sell off his shares when he discovered that 85% of Nigerians are defaulting in that regard.

He sells them off to Chuks, his stockbroker at $950, who later sells them to Amanda for $1000.

Due to the spread, Chuks has made a profit of $50 from the transaction.

When presented with a standard bid and ask price for a currency, the higher price is what you would pay to buy the currency, and the lower price is what you would receive if you were to sell it.

Learn the Art of Forex Trading

Do you want to know more about trading? Start your free five-day trial in any of our courses right now.

We have three powerful courses to get you started, regardless of your learning style. You can choose courses taught by real-world experts and learn at your own pace with Jayyy Forex Academy, which offers lifetime access on mobile and desktop. You’ll also learn the fundamentals of trading, other financial assets, advanced forex strategies, and much more. Learn more about Jayyy Forex Academy and get started right away.

Conclusion

As you’ve been enlightened on the concepts of bid, ask and spread with relatable examples.

Do you find this article helpful?

Which section do you find most juiced with information? Would you want more of this? Your reply in the comment section below will be highly appreciated! Thank you.

[…] favor is what forex trading is all about. The broker quotes or displays currency rates as bid and ask prices. The ask price is quoted to an investor who wants to go long or buy a currency, and the bid price […]